Understanding Window Dressing 🧐

Window dressing refers to the tactics employed by mutual funds, portfolio managers, and institutional investors to make their portfolios appear more attractive at the end of a reporting period. This is achieved by selling off underperforming assets and buying into high-performing stocks, often those that have shown strong gains during the quarter. The intention is to present a healthier, more successful portfolio to clients and investors in quarterly reports, thereby potentially influencing investment decisions.

The Impact on the Market 💹

The window dressing effect can lead to noticeable fluctuations in stock prices as the quarter ends. Stocks that are added to portfolios may experience a temporary surge in demand, driving up prices, while those being discarded may see their prices fall. This artificial inflation (or deflation) of stock prices, detached from fundamental company performance, can create misleading signals for some beginner traders and individual investors.

Strategies for swing traders 🛠️

Given the transient nature of the window dressing effect, there are several strategies that individual investors might consider:

- 🔍 Stay Informed: Awareness of window dressing practices can help swing traders discern between genuine market trends and end-of-quarter anomalies.

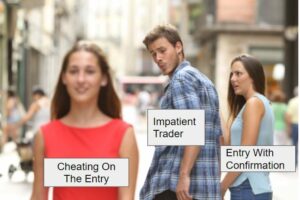

- 🌅 Detect Short-Term Market Manipulation: Focusing on buying strength and shorting weakness.

- 🎯Quality Over Quantity: trading less is actually making more; focus on clear trading signals, and do not focus on buying weaknesses and bottoms, at least this week.

- 🔄Consider the Aftermath: The period following window dressing adjustments can present buying opportunities as the market corrects and prices realign with fundamentals.

The Bigger Picture 🌍

While window dressing can influence market dynamics in the short term, its effects are generally temporary. The underlying value of a company, as reflected in its fundamentals, eventually prevails in determining stock prices. Therefore, while it’s important for investors to be aware of these practices, decisions should not be based solely on these end-of-quarter movements.

Ethical Considerations 🤝

The practice of window dressing raises questions about transparency and the ethical obligations of fund managers to present an accurate picture of portfolio performance. Investors should seek out funds and managers who prioritize long-term growth and transparent practices, aligning with the investor’s own values and investment philosophy.

Conclusion 🎬

As we approach the end of the quarter, the window dressing effect is a reminder of the complexities and strategies at play in the financial markets. By understanding these practices and their impact, investors can better navigate the short-term waves while keeping their long-term investment objectives in clear view. In the ever-evolving landscape of investing, knowledge remains the most valuable asset.